Emerging Asset Class Opportunities

As we approach 2025, the investment landscape is evolving rapidly, and one of the most exciting areas to explore is emerging asset classes. These opportunities often lie in sectors that are gaining traction due to technological advancements, societal shifts, or economic trends. For instance, digital assets like cryptocurrencies and blockchain-based technologies are becoming increasingly mainstream, offering new ways to diversify portfolios. Additionally, green energy investments, such as renewable energy projects and carbon credits, are growing in popularity as the world prioritizes sustainability. Private equity in innovative startups, particularly in fields like artificial intelligence, biotechnology, and clean technology, also presents significant potential for high returns. By staying informed and agile, investors can position themselves to capitalize on these promising opportunities.

Economic and Market Trends

As we approach 2025, understanding economic and market trends is crucial for making informed investment decisions. One of the key trends to watch is the shift in global economic power. Emerging markets, particularly in Asia and Africa, are expected to grow at a faster pace than developed economies. This means investors should consider diversifying their portfolios to include opportunities in these regions. Additionally, technological advancements, such as artificial intelligence and renewable energy, are reshaping industries and creating new investment avenues. Keeping an eye on inflation rates, interest rate policies, and geopolitical events will also be essential to navigate market volatility effectively. By staying informed and adaptable, you can position yourself for success in the evolving financial landscape.

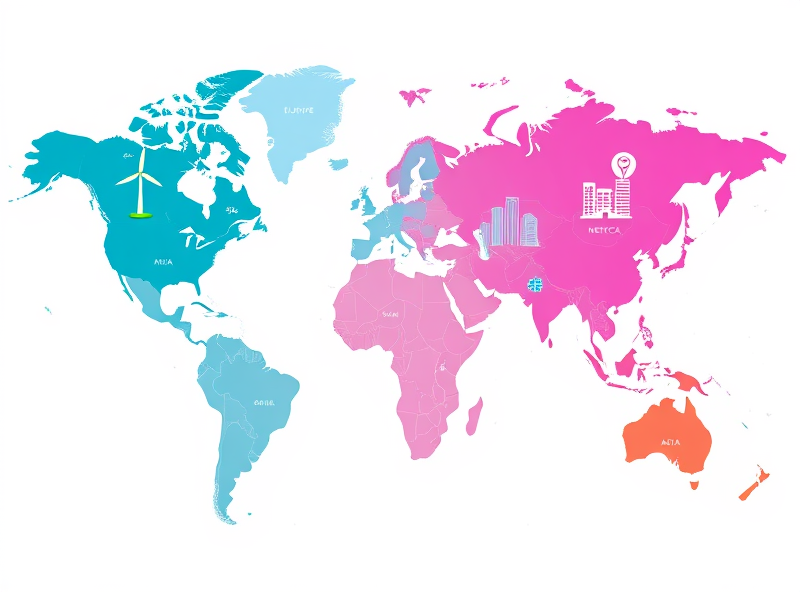

Region-Specific Investment Insights

When it comes to making smart investment decisions, understanding regional dynamics is crucial. Each region offers unique opportunities and challenges based on its economic trends, industries, and geopolitical landscape. For instance, in North America, the tech sector continues to dominate, with AI and green energy startups gaining traction. Meanwhile, in Asia, rapid urbanization and digital transformation are creating investment opportunities in real estate and e-commerce. Europe, on the other hand, is focusing on sustainable energy and infrastructure development. By tailoring your investment strategy to the strengths and growth areas of specific regions, you can maximize returns while minimizing risks. Stay informed about local policies, market trends, and cultural nuances to make well-informed decisions.

Market Risks and Diversification Strategies

In the ever-changing world of investments, understanding market risks and implementing effective diversification strategies are key to achieving long-term success. Market risks, such as economic downturns, geopolitical tensions, or unexpected industry disruptions, can significantly impact your portfolio. However, diversification acts as a safety net, helping to mitigate these risks by spreading investments across various asset classes, industries, and geographic regions. For example, instead of putting all your funds into a single stock or sector, consider allocating your investments into a mix of equities, bonds, real estate, and even alternative assets like commodities or emerging markets. This approach reduces the impact of a poor-performing asset on your overall portfolio. Additionally, regularly reviewing and rebalancing your portfolio ensures that your investments remain aligned with your financial goals and risk tolerance. By staying informed and proactive, you can navigate market uncertainties with confidence and build a resilient investment strategy for 2025 and beyond.